retroactive capital gains tax september 2021

This plan was made to be retroactive in order to make it harder for investors to prepare. Analysts at Penn-Wharton concluded that Bidens proposed capital gains tax increase would lower federal revenue by 33 billion rather than raise the administrations estimate of 370 billion or more14 The Penn-Wharton tax model generally produces results that are similar to those of the Congressional Budget Office which suggests that.

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

Up until now the tax rate on capital gain has been zero 15 or 20 depending on your income.

. In some cases you add the 38 Obamacare tax but at worst your total tax bill is 238. Up until now the tax rate on capital gain has been zero 15 or 20 depending on your income. Biden unveiled a budget proposal Friday June 4 2021 that called for a 396 top capital gains tax rate to help pay for the American Families Plan.

Under the HWM Proposal this rate will increase to 25 for both kinds of income. The higher rate will be effective for qualified dividends paid or sales that occur on or after September 13 2021 when the proposal was released. The long term capital gain tax is graduated 0 on income up to 40000 15 over 40000 up.

Are retroactive tax increases constitutional or even fair. But additionally he wants this implemented retrospectively to April 2021. The 20 tax rate on capital gains can raise as high as 318 for some individuals.

An exception to this retroactive effective date applies to written binding contracts in effect as of September 12 2021 in the case of the 50 limit on the gain exclusion for QSBS or September 13 2021 in the case of the increase in the long-term capital gains rate provided that the contract is not modified thereafter in any material respect. A Retroactive Capital Gains Tax Increase. Top earners may pay up to 434 on long-term capital gains including the 38 Net Investment Income Tax.

September 07 2021 Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is critical for many investment decisions. Perhaps had Congress looked to enact such changes earlier in 2021 the chance to make the capital gains tax changes retroactive to perhaps the start of the year would have been greater. It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021.

The treatment of gifts at death as sales that require capital gains tax to be paid on amounts over 1 million. A retroactive to April or May of 2021 increase in long-term capital gains rates for taxpayers with adjusted gross income above 1 million. Sep 7 20211048am EDT Listen to article Share to Facebook Share to Twitter Share to Linkedin Are retroactive tax increases constitutional or even fair.

The presidents proposed 434 capital gain rate is supposed to hit only those earning 1m or more but if you bought a house 30 years ago that is now worth over 1m you. The capital gains tax increase as of September 13 2021 there are no retroactive taxes in the proposal affecting individuals estates or trusts. Some of these provisions if enacted would have effective dates retroactive to the date the legislation was proposed September 13 2021.

Biden plans to increase this to 434 percent for households earning more than 1 million. Date Published 08072021. Who would see another 3 tax raise.

In late May specific details of President Bidens tax proposals were released including. On The Retroactive Capital Gains Tax Hike. 1 Congress already passed one budget reconciliation bill in 2021 The American Rescue Plan which was for the fiscal year ending 2021.

By SBE Council at 30 September 2021 1056 am Higher Capital Gains Taxes Retroactive Increases at Death Most Harmful. An exception to this retroactive effective date applies to written binding contracts in effect as of September 12 2021 in the case of the 50 limit on the gain exclusion for QSBS or September 13 2021 in the case of the. Capital gains that are long-term gains and so-called qualified dividends are taxed currently at a maximum rate of 20.

The long term capital gain tax is graduated 0 on income up to 40000 15 over 40000 up to 441450 and 20 on income. September 4 2021 at 323 pm71036 Kaye Thomas Moderator Congress has never enacted a tax law that is retroactive in the way you indicate so we dont have a definitive answer to the question whether it would be unconstitutional. Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year.

Are retroactive tax increases constitutional or even fair. Up until now the tax rate on capital gain has been zero 15 or 20 depending on your income. Call Us Now To Schedule An Appointment.

Policies that increase taxes tax on capital income ie capital gains dividends and the corporate income tax rate are found to be more harmful than those that at least in part also increase taxes on labor income 39. Retroactive capital gains tax september 2021. In some cases you add the 38 Obamacare tax but at worst your total tax bill is 238.

Up until now the tax rate on capital gain. On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be retroactive to April 2021. 2 Proposed Biden Retroactive Capital Gains Tax National axpayers Union ondation Could Be Challenged on Constitutional Grounds levying a 10 percent surtax on high earners6 imposing a one-time 25 percent wealth tax7 and imposing an annual 2 percent or 3 percent wealth tax8 One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238.

This would prevent wealthy people from quickly selling off their assets before the end of the year to avoid the hike. In areas above that income level rates increase by 20 percent. The proposed budget would increase the taxes on capital gains for Americans earning more than 1 million to 434 which makes the rate the same as these individuals regular income tax rate completely eliminating the tax benefits of capital gains.

The proposal specifies the change will take effect retroactive to September disallowing investors from selling their position before the change.

Time Is Running Out Close Before December 31st 2021 For Potentially Significant Tax Savings Newbridge Group

Crystal Ball Gazing To The Past Article By Pearson Co

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra

Biden S Proposed Retroactive Capital Gains Tax Increase

Crystal Ball Gazing To The Past Article By Pearson Co

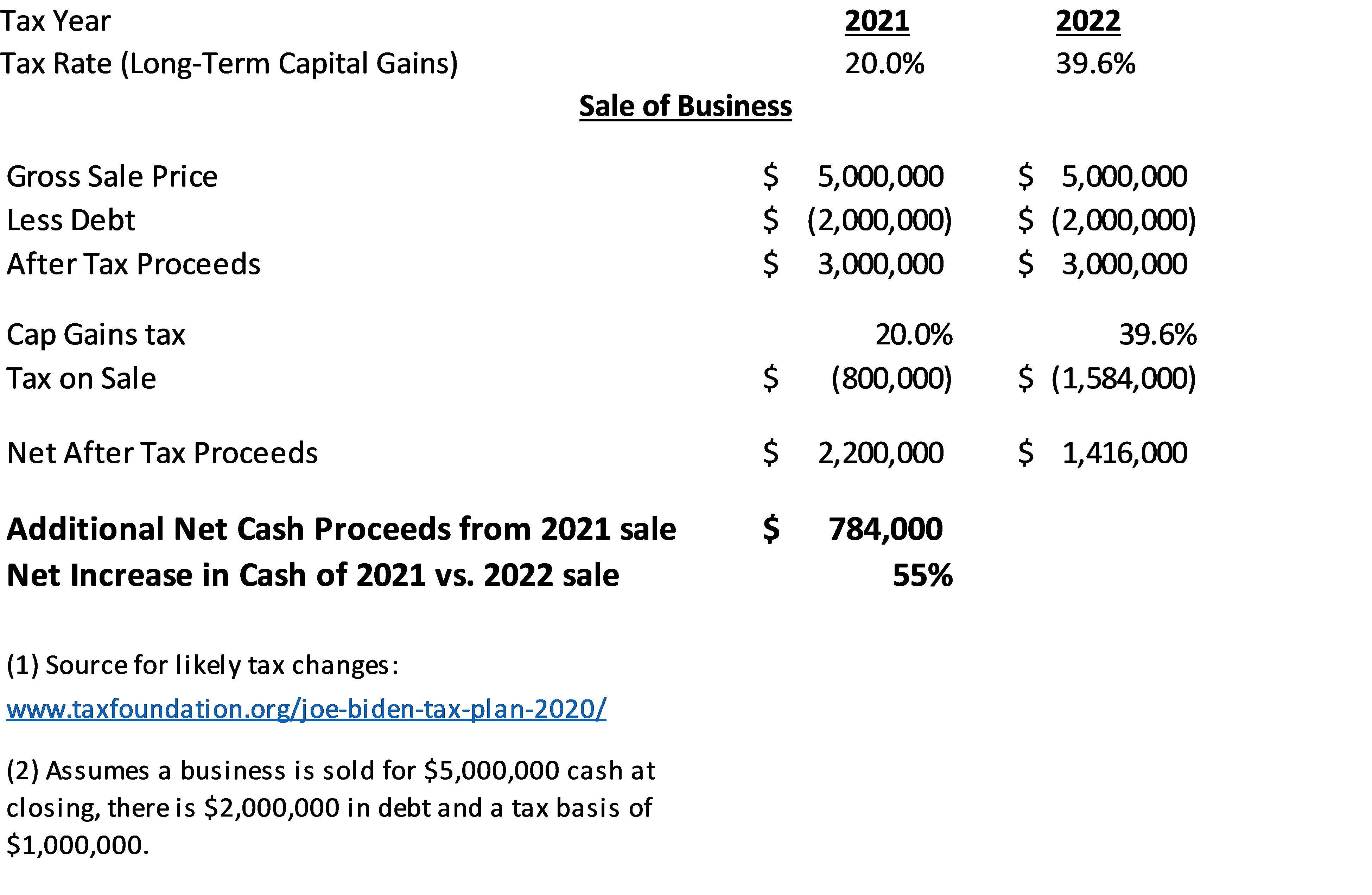

Capital Gains Tax For Business Sellers In 2021 Hahnbeck

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

The Capital Gains Rate Historical Perspectives On Retroactive Changes Lexology

Wall Street Panicking That Biden S Tax Hikes Will Be Retroactive

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

Capital Gains Tax New Formulas For Its Calculation Firmalex

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

If The Build Back Better Bill Does Pass In 2022 Will The Capital Gains Qsbs Changes Still Be Retroactive To 2021 R Fatfire

Managing Tax Rate Uncertainty Russell Investments

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others